POPULAR ARTICLES

- What is Accounts Payable - Meaning, Process, Examples, Formula

- Accounts Payable Cycle: What is the Full Cycle Accounts Payable Process?

- Accounts Payable Journal Entry: Types & Examples

- 2-Way & 3-Way Matching in Accounts Payable Explained

- What is 4-Way Matching in Accounts Payable and How It Works?

- What is Invoice Processing? Meaning, Steps, Flowchart, Benefits

- All About Automation of Vendor Management in Accounts Payable

- SAP Tcodes for Accounts Payable: SAP Transaction Codes List for Accounts Payable

- What is Debit Balance in Accounts Payable? - Meaning, Example, Reasons

- Accounts Payable Aging Report: Meaning, Uses, How to Generate, Analysis

- Accounts Payable Turnover Ratio: Formula, Calculation, Example, How To Improve AP Turnover Ratio

- Days Payable Outstanding (DPO): Formula, Calculation, Example

- Accounts Payable Reconciliation: How to Reconcile Accounts Payable?

- Accounts Payable Fraud Detection and Prevention Controls

RELATED ARTICLES

- Invoice Discounting: A Guide to the Process, Advantages, and Different Types

- What is Invoice Financing: Process, Examples and FAQs

- All about Trade Receivables Discounting System (TReDS) Online Platform

- FAQs on Invoice Discounting

- Bill Discounting vs. Bill Purchase: Best Invoice Financing Option?

- Basic Difference Between Invoice Financing vs Trust Receipt

- Key Difference Between Factoring and Forfaiting

- Factoring vs reverse factoring- which benefits vendors

What is Procure to Pay (P2P)? Process, Cycle, Benefits, Best Practices

The procure-to-pay process is an end-to-end workflow for buying goods and services, starting from discovering the need for it to settling dues with the vendor. The P2P process is called so because of the ordered sequence of different activities, from the first steps of procuring goods to the final step of paying for them.

Read along as we discuss the procure-to-pay process, including the different stages, importance, and best practices.

Key takeaways-

- Procure to pay process is also popularly known as P2P process.

- Procure to pay process starts from procurement and ends with invoice payment.

- P2P process helps in cost management by avoiding duplicate orders and payments errors.

What is Procure-to-Pay?

Procure-to-pay process is the business process of requisitioning, purchasing, receiving, and paying for products and services. P2P process is a set of integrated activities that helps a company obtain the required goods or services from a supplier.

It helps companies streamline procurement, control costs, and improve vendor management.

By automating this process, i.e., integrating it with accounts payable, vendor payment systems, and invoice management, you can ensure compliance, accuracy, and efficiency.

Why is The Procure-to-Pay Process Important?

A P2P process helps organisations manage their spending and reduce costs. It can also help you save costs by reducing manual and laborious tasks.

Besides these, here are some reasons why a P2P process is important:

- Streamlines the procurement process by clearly defining all the necessary actions.

- Allows buyers and suppliers to keep track of invoices and the payment progress.

- Strengthens relationships with suppliers by ensuring timely payment and resolving issues promptly.

- Prevents mistakes such as duplicate orders, overpaying, and payment errors.

Procure-to-Pay (P2P) Process

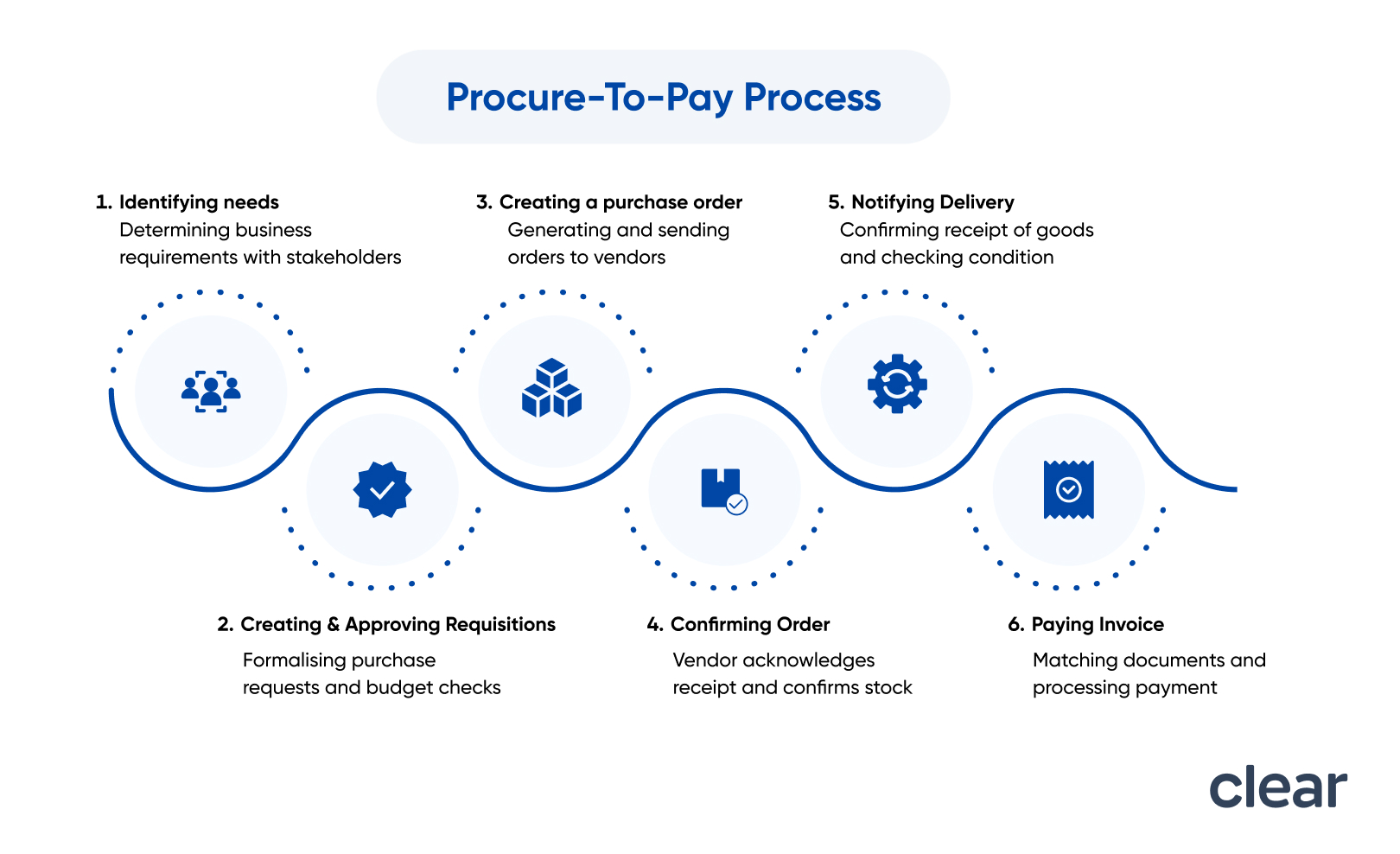

Procure-to-pay includes all the stages between buying goods or services from a supplier and paying for them. Here are the six different stages of a P2P process:

Step 1: Identify needs:

The first phase in the procure-to-pay process is determining and defining the business requirements with the assistance of cross-functional stakeholders. Once a valid need is determined, procurement teams prepare high-level specifications for goods/products, terms of reference (TOR), and statements of work (SOW).

Step 2: Create and Approve Requisitions:

A formal purchase requisition is created once the specifications are finalised. A requester sends the completed purchase requisition form after confirming that all administrative requirements are met. After reviewing the requirement, checking the available budget, and validating the purchase request form, approvers can approve or reject a purchase requisition.

Step 3: Create a Purchase Order (PO):

Once a vendor has been found, purchasers must negotiate with them. However, this can be time-consuming unless your company has a contract with defined conditions. At this point, the department generates a PO for the required products, records the PO as a separate record in its books, and sends the order to the vendor for fulfilment.

Step 4: Confirm Order:

The vendor receives the PO and sends a confirmation of receipt, usually with an acknowledgement that their stock levels are enough for fulfilment. They also inform the company about the expected turnaround time and shipment date.

Step 5: Notify Delivery:

The acquired products will arrive, and your company must send a delivery confirmation to the vendor. It is vital to compare the shipment to the PO to ensure everything arrives in good shape. It is also critical to highlight exceptions such as damaged or missing items to avoid paying for things that were not received.

Step 6: Pay Invoice:

Using your provided information, the vendor makes any required deductions and then sends an invoice to your company. This is where the P2P's three-way match and four-way match takes place. Three-way match verifies that all the information reconciles with the original PO, the delivery receipt, and the invoice. Four-way matches invoices, POs, goods received notes (GRN), and inspection reports.

Example of Procure-to-Pay

Here’s an example of the procure-to-pay process to help you get a better understanding:

XYZ Electronics, a consumer electronics manufacturer, must procure electronic parts for a new product they are developing.

Here is what their procure-to-pay process would look like:

- Requisition: The product manager identifies the need for specific electronic components and submits a purchase requisition containing details about the parts through the company's procurement system.

- Supplier Selection: The procurement team reviews the requisition and evaluates potential suppliers based on price, quality, and delivery capabilities. After a thorough review, they decided to work with Supplier A.

- PO Creation: The procurement team generates a PO using a standardised template, specifying the quantity, price, delivery date, and terms and conditions. The PO is electronically sent to Supplier A for acknowledgement.

- Receipt and Inspection: When the parts arrive at XYZ Electronics, the receiving department checks the shipment against the PO to ensure it matches the order in terms of quantity and quality.

- Invoice Processing: Upon successful receipt and inspection, the supplier sends an invoice to XYZ Electronics, referencing the PO number. The finance department matches the invoice to the corresponding PO and receipt documentation.

- Payment: Once the invoice is approved, it is scheduled for payment based on the agreed-upon payment terms with Supplier A.

P2P Cycle

P2P cycle is the end-to-end business process starting from identifying the requirement of goods and services to making payments for invoices. Below are the typical stages in a P2P cycle-

Stage 1: Requisitioning: First stage involves initiating and approving a request for goods or services by the procurement team.

Stage 2: Supplier Selection: In this stage, procurement team must evaluate and choose a supplier for the required goods/services in collaboration with production and AP teams.

Stage 3: Purchase Order Creation: At this stage, finance team generates and issues a purchase order (PO) with specified details to the chosen supplier.

Stage 4: Order Fulfilment & Goods Receipt: Upon receiving the goods/services as delivered by the supplier, it is inspected and accepted/rejected.

Stage 5: Invoice Management: In this stage, the finance team receives and verifies the supplier’s invoice, reconciling it with the PO and delivery records.

Stage 6: Payment Processing: It is a crucial stage where the invoice is approved and payment is executed to the supplier.

Step 7: Reporting: In the last stage, the invoice payment is reported in the accounting records against the vendor.

Benefits of Efficient Procure-to-Pay Process

The primary benefits of an efficient P2P process are:

- Cost-Savings: Streamlining the P2P process reduces operational costs associated with manual tasks, errors, and delays.

- Time-Saving: Automating repetitive tasks, such as data entry and invoice matching, allows employees to focus on more strategic activities.

- Strategic Decision-Making: Companies can use the data and insights gathered from the P2P process to make informed decisions about supplier selection, contract negotiations, and sourcing strategies.

- Improved Vendor Management: An efficient P2P process streamlines a company’s vendor management processes by helping you shortlist vendors quickly, negotiate prices, and track their performance.

- Customer Satisfaction: Streamlined procurement processes ensure that goods and services are readily available, which, in turn, helps meet customer demand and improve satisfaction.

- Competitive Advantage: Companies with an efficient P2P process can respond more quickly to market changes and opportunities, gaining a competitive edge.

Best Practices for Procure-to-Pay Process

Now that you know the advantages of an efficient procure-to-pay process, here are some best practices that you can follow to streamline it:

- Establish clear P2P policies that outline roles, responsibilities, and the step-by-step process.

- Communicate with suppliers to address issues promptly.

- Negotiate payment terms with suppliers, taking advantage of early payment discounts when possible.

- Implement an automated procure-to-pay system.

- Improve collaboration between different departments, such as procurement and accounts payable.